GDeep™

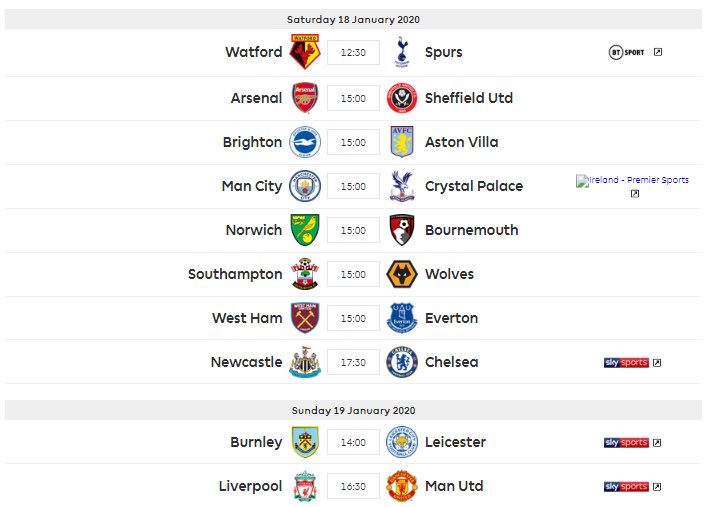

League is very weak

I don’t ever remember having any serious football related dialogue with you.Just nice seeing you type those words after you attacked me daily when I said Maguire was stupid at 80M.

I don’t ever remember having any serious football related dialogue with you.Just nice seeing you type those words after you attacked me daily when I said Maguire was stupid at 80M.

I don’t ever remember having any serious football related dialogue with you.

What a f*cking bellend (if this is true).

Credit to @Beksl, he was spot on about Maguire. You on the other hand I don’t remember posting anything worth reading on this subject.

Oleh done, Haaland next.

Blimey.

@American_Gooner got the receipts bro?

Surely they should sign a Greek central defender?What a f*cking bellend (if this is true).